An intellectual virus, a bubble, or both?

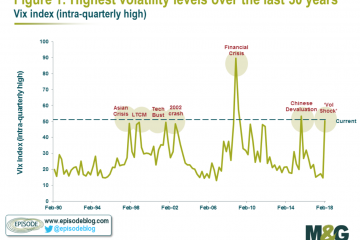

The recent phase of market volatility precipitated by the February 2018 ‘flash crash’ has morphed into fears of a growth slowdown, phoney Trumpian trade wars, and real wars. But the initial crash itself may be ...