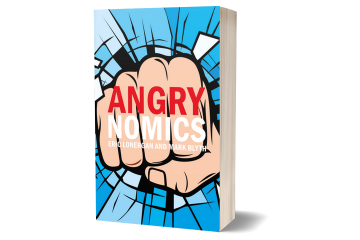

Highs & lows of economics: Kilkenny, crypto, and inflation

Economics keeps letting me down. The decade or so following the financial crisis spawned thousands of papers researching the financial system. I had a sinking feeling that none of it would help. Policy-making ...